how much does the uk raise in taxes

The average Band D council tax set by local authorities in England for 2022 to 2023 will be 1966 which is an increase of 67 or 35. 1 day agoHow much will your council tax increase by.

How To Raise A Proper British Child In 20 Steps Taxes Humor Accounting Humor Funny Quotes

You do not get a.

. For the self-employed rates will go up from 9 per cent and 2 per cent to 1025 per cent and 325 per cent. That would be an extra 91000 in tax revenue per person. The map below shows the percentage increases for council tax band D across England and Wales using data from govuk and Stats Wales.

875 for basic rate taxpayers 3375 for higher rate taxpayers and 3935 for additional rate taxpayers. Total tax receipts in 201718 are forecast to be 690 billion. In line with the 6 percent CT rate increase the rate of Diverted Profits Tax will also increase by 6 percent to 31 percent from April 2023.

The poorest 10 pay 4000 in tax mostly indirect VAT excise duty. However inequality in the UK has increased since 1980. Increasing the point at which people start paying it will cost.

The increase is projected to bring in additional revenues of 119 billion in 2023-24 rising to 172 billion in 2025-26. In 202021 the value of HMRC tax receipts for the United Kingdom amounted to approximately 556 billion British pounds. The original 125 percentage point increase in National Insurance was supposed to raise 12bn a year.

The energy price cap will soar 54 per cent today. They receive around 2000 in benefits. This is slightly below the average for both the OECD 34 and G7 36 and considerably lower than many other European countries average tax revenue among the EU14 was 39 of GDP in 2019.

Payments will only be collected on wages above 9880 although this rises to 12570. Mr Sunak described the measures as a 6 billion personal tax cut for 30 million people in the UK stating that 70 per cent of workers would pay less tax even after the. Income tax National Insurance contributions NICs and value added tax VAT.

You can also see the rates and bands without the Personal Allowance. Together these raise over 460 billion. The earliest records held at the Institute of Fiscal Studies are for the tax year 197879 when the UK Government raised 49billion in VAT.

The richest 10 pay over 30000 in tax mostly direct income tax. Overall the average household pays 12000 in tax and receives 5000 in benefits. Fuel is exorbitantly e.

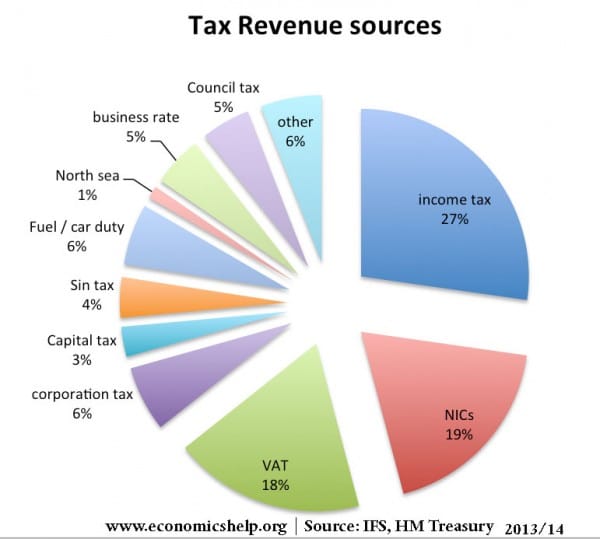

UK tax revenues were equivalent to 33 of GDP in 2019. There are three main sources of funding. How much does the UK raise in tax compared to other countries.

1 day agoAccording the Governments Wednesday morning release. Government revenue comes from taxes. This represented a net increase of.

The average band D council tax bill has increased by 35 in England up 67 compared to 2021-22. Increases added to the rate applied from 9568-50270 of earnings 12 and to the rate charged on earnings above that 2 It will be extended at that point to cover pensioners who are. This represented 7 of the governments total revenue in that year.

April storm AS a grim era of economic woe begins the Tories must brace for a battering. The dividend ordinary rate will be set at 875. Over 820 billion is raised annually from taxes social security contributions and other sources by the UK government equivalent to around 37 of its GDP based on its estimates.

Alongside the levy which will be paid by employees the self-employed and businesses the government has announced a 125 increase in dividend tax rates from 1 April 2022 taking rates to. For comparison that sum would be worth 245billion today based on historic inflation. Uk Tax Revenue 2019 Statista The Top Rate Of Income Tax British Politics And Policy At Lse The Pay Raise Is Just Large Enough To Increase Your Taxes And Just Small Enough To Have No Effect On Your Take Home Pay Humor Quote Posters Fun At Work.

How much does the uk raise in taxes Monday February 21 2022 Edit. The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system. UK government raises around 800 billion a year in receipts income from taxes and other sources equivalent to around 37 of the size of the UK economy as measured by GDP.

This measure increases the rates of Income Tax applicable to dividend income by 125. But receive over 5000 in tax credits and benefits. Receipts have recovered their pre-recession share of national income and on current policy are set to rise slightly as a share of national income between now and 201920 and then remain relatively flat until the end of the forecast horizon Figure 1.

What is the tax increase for. Taxes as defined in the National Accounts are forecast to raise 6229 billion equivalent to roughly 11800 for every adult in the UK or 9600 per person. The majority are from three main sources.

Income tax National Insurance contributions NICs and value added tax VAT.

Typetopia On Instagram The Pink Tax By Magoz Submit Your Work With Typetopia Pink Tax Pink Creative Ads

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

Following The Biggest Gap Between Budgets Since Before 1900 New Chancellor Rishi Sunak Will Prese Social Worker Resources Economic Research Economic Analysis

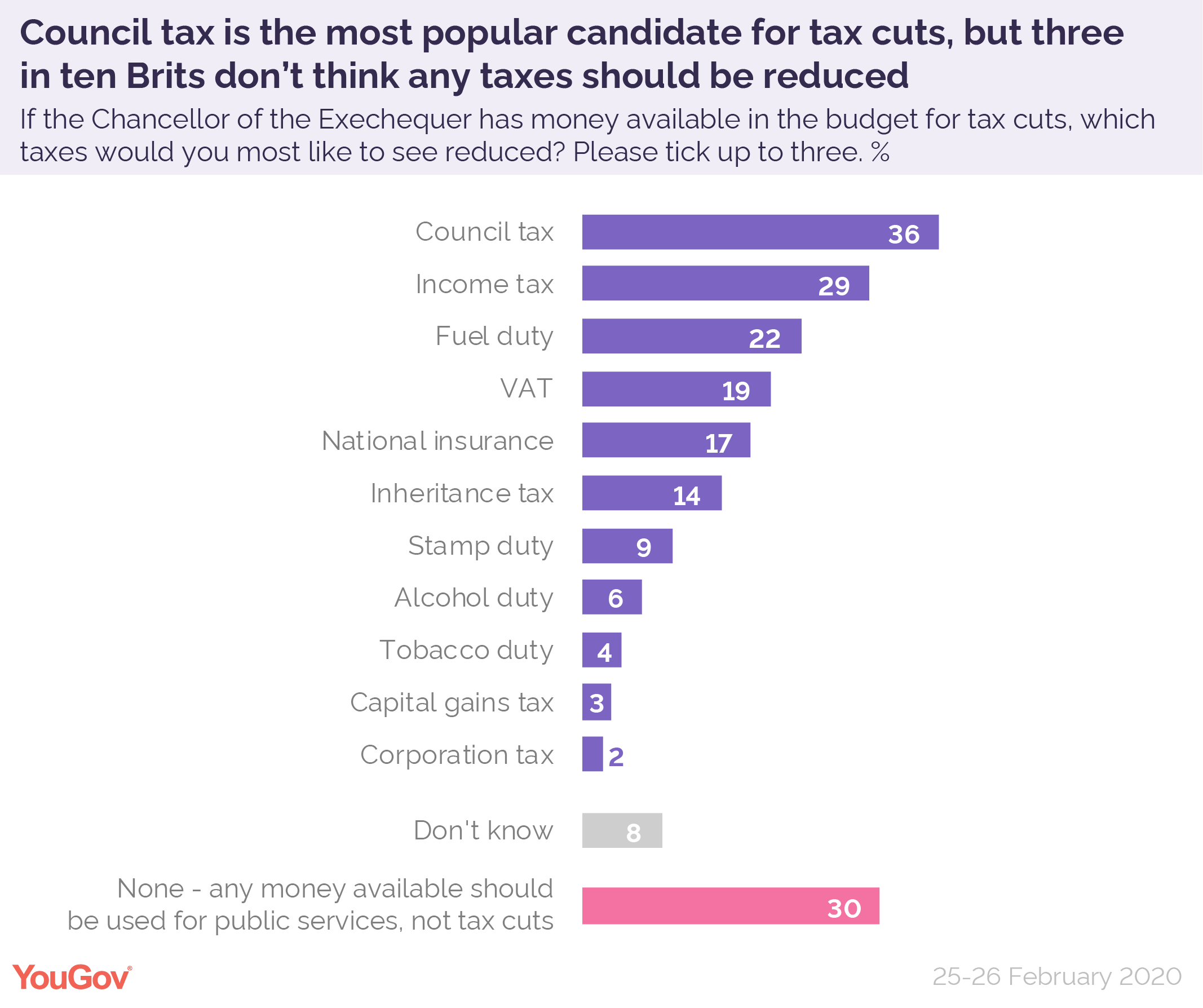

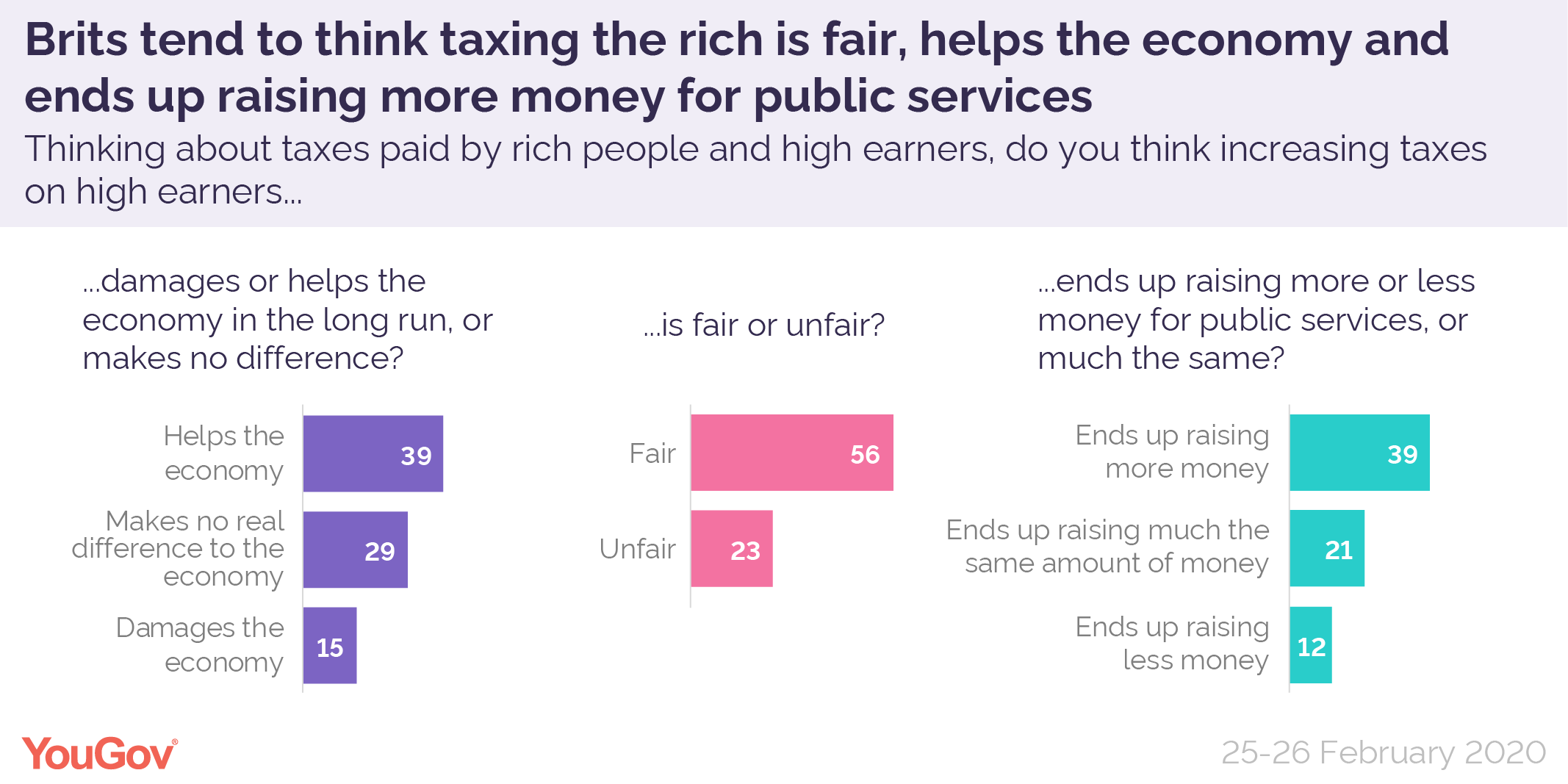

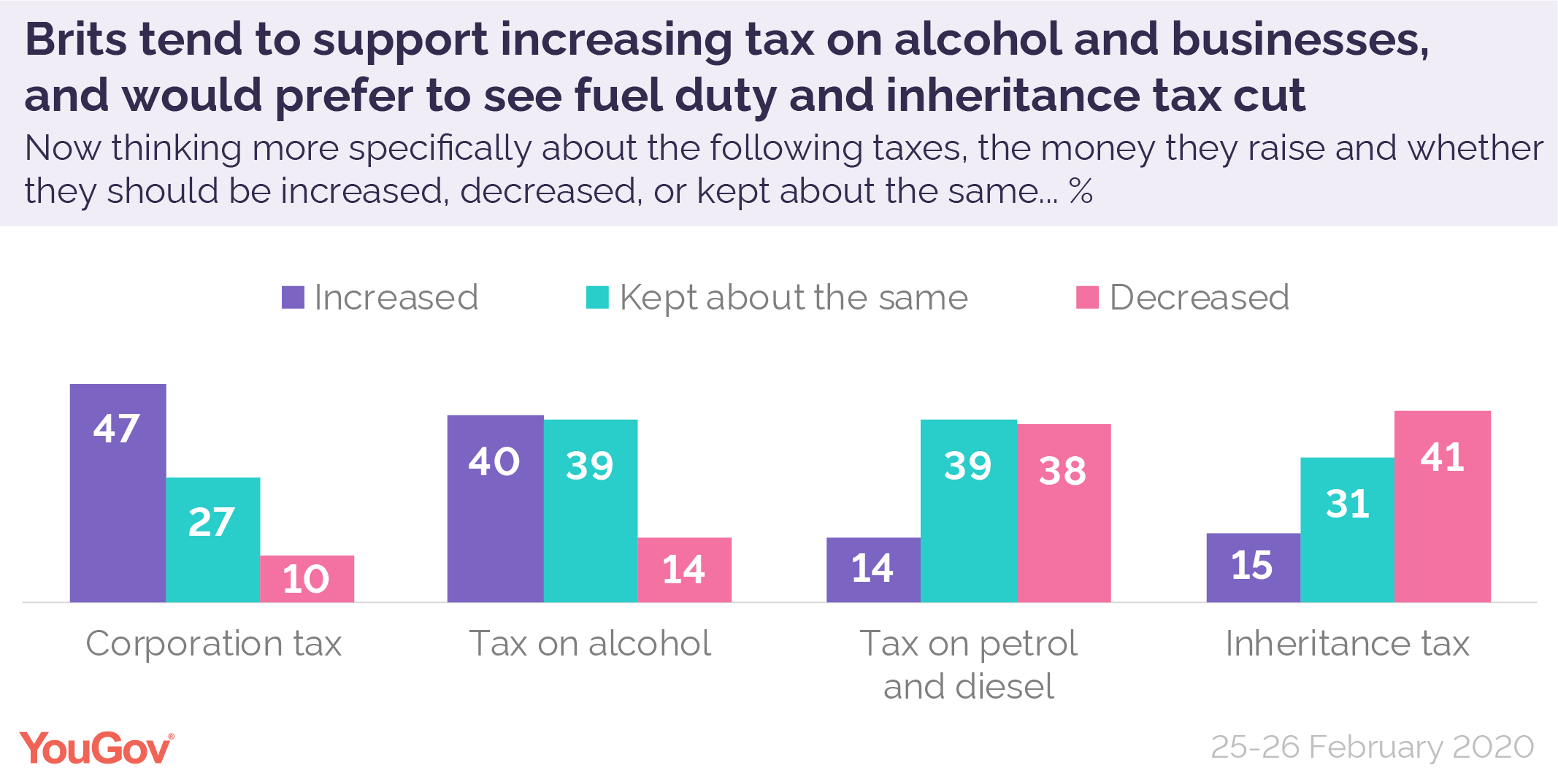

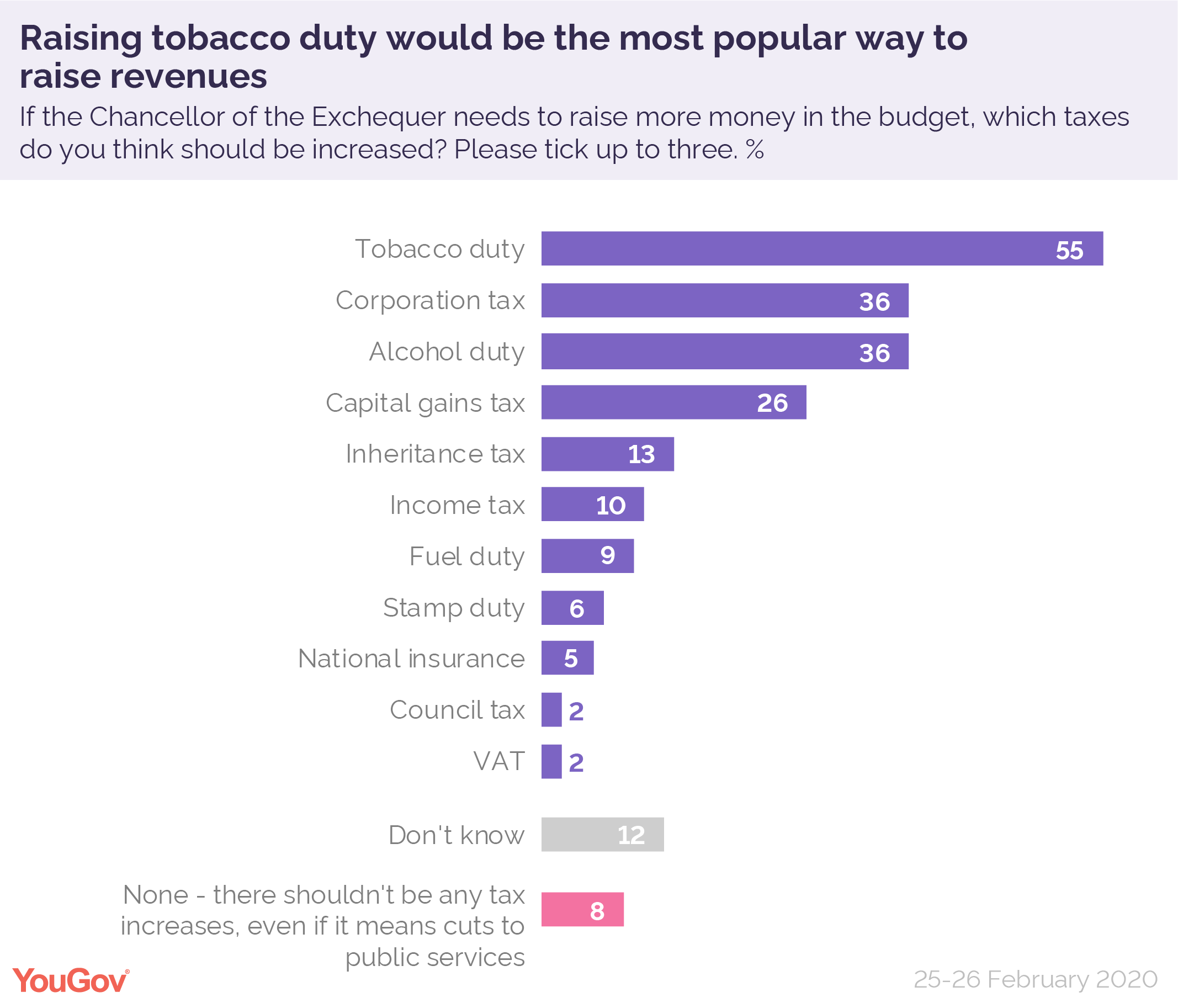

Budget 2020 What Tax Changes Would Be Popular Yougov

Trump Republican S New Corporate Taxscam The Inescapable Conclusion Of A New Itep Report Assessing The Taxpa Skills Professional Business Cards Foil Stamping

Raise Our Taxes Obama Quote Power To The People Tax

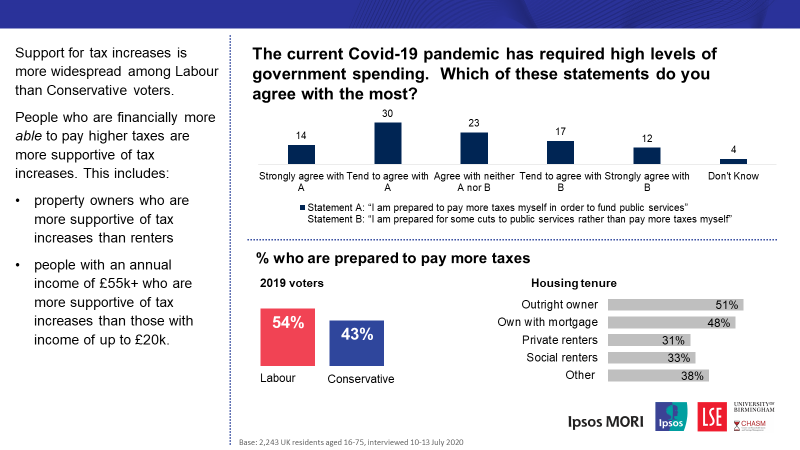

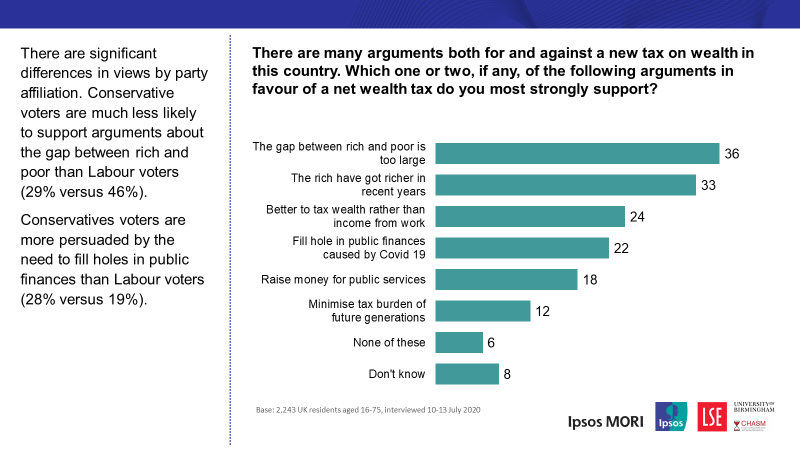

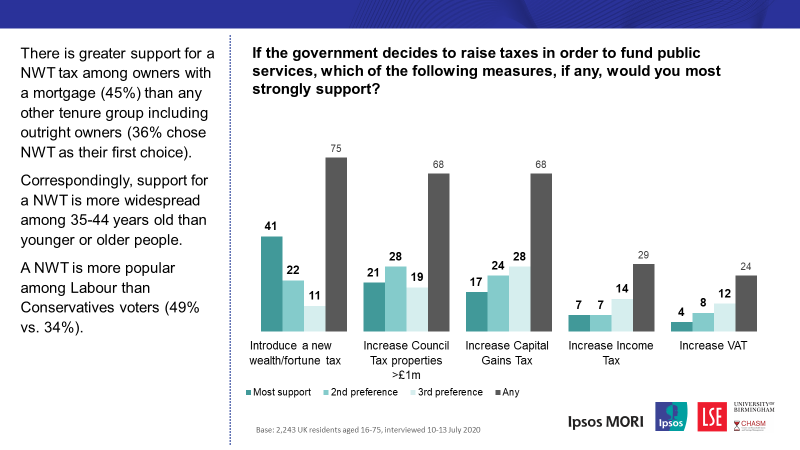

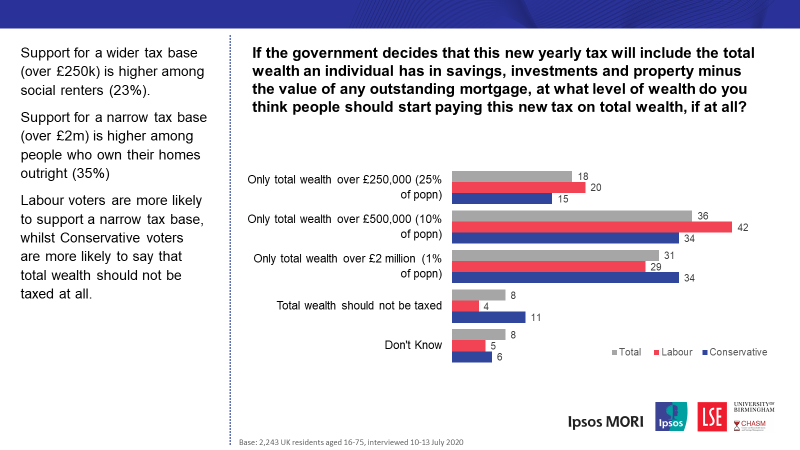

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

Budget 2020 What Tax Changes Would Be Popular Yougov

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

Top Money Paid By Clickbank And Clicksure Go To This Website Http Im 6p3qdhcw Yourreputablereviews Com Charts And Graphs Tax Return Graphing

Budget 2020 What Tax Changes Would Be Popular Yougov

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

Council Tax Increases 2021 22 House Of Commons Library

Budget 2020 What Tax Changes Would Be Popular Yougov

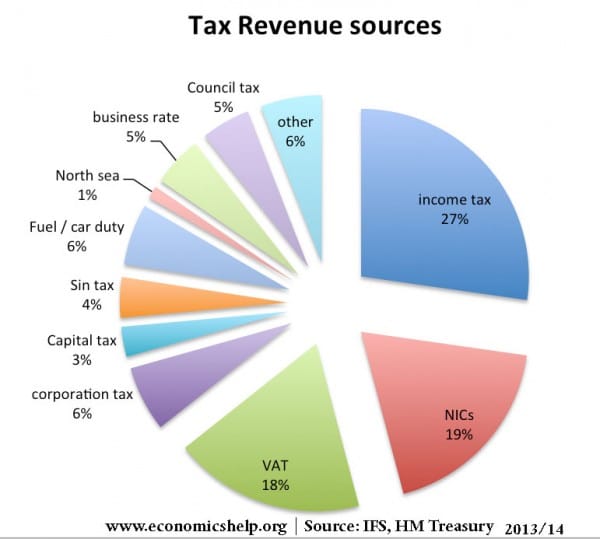

Types Of Tax In Uk Economics Help

9 Ways To Choose Your Own Crowdfunding Adventure Freelance Business Tax Refund How To Raise Money